Archive for the ‘finance’ Category

Taxes at two WalMart’s

I noticed a WalMart receipt in our car that shows a tax rate of 9% plus 1.25%. That seemed kind of high.

Apparently, Elgin has a “special business district” tax rate that is 9%, and then there’s a 1.25% on top of that (presumably County Home Rule), which totals to 10.25%.

It looks like the tax rate in Algonquin would be between 1.25% to 2.5% lower than that in Elgin (Kane County). The Illinois tax rate finder web site predicts 7.75% for Algonquin. It predicts 9% for Elgin (Kane County special business district).

The Illinois web site (below) doesn’t show the 1.25% adder for Elgin’s “special business district”. So, I don’t know if that 1.25% gets added to the Algonquin’s 7.75% as well (in which case the difference would only end up being 1.25%).

Refinance Calculator

Nice little calculator to tell you if it’s worth it to refinance or not:

Refinance Calculator.

The same website has a lot of references (and survey of media and books) covering other calculators and advice.

Have a Visa card? Free extended warranty

I recently came across this article, that states that it usually doesn’t make sense to buy the extended warranty at (for example) Best Buy, because most credit cards (MasterCard, Visa, and American Express) offer extended warranties provided you bought the item with the card.

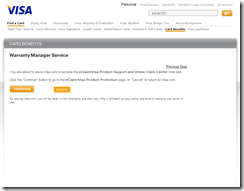

So, for kicks, I went through the process to see what it’d take. First, go Visa’s Warranty Manger page:

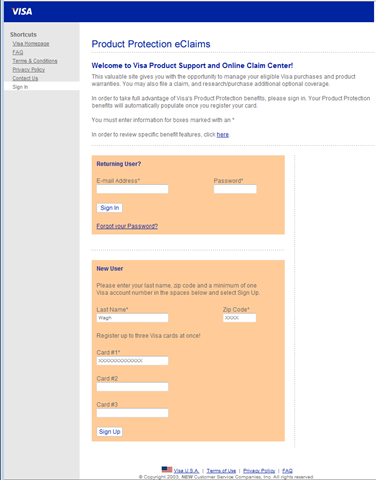

Then, from there, you’ll go through a secure connection that asks you to register your card:

I paused here for a moment, because even though the site is secure (the text in the location bar starts with https://), it points to https://portal.newcorp.com/visaclaims/servlet/VisaClaimsProcessRunner?USER_ACTION=ShowWelcome. I’m not sure who newcorp is. However, it was linked to from visa.com, so I took a small chance.

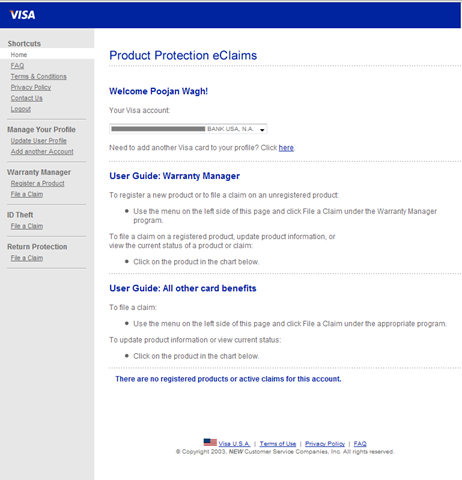

You enter a bunch of information (address, email, phone number, etc.) and when all is said and done, you end up here:

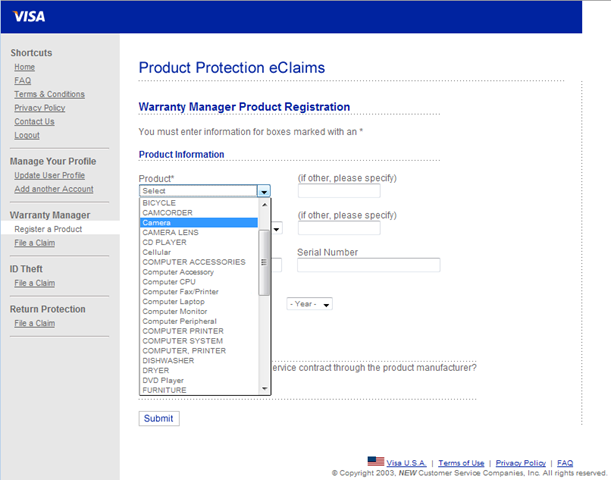

At which point, you can formally register a product:

“Yes, Warranty Manager registration service helps you take full advantage of your warranties, because you can get key information about your coverage. And if you send us your sales receipts and warranty information, we’ll keep everything on file – so arranging for a repair becomes much easier. It also helps expedite the process in the event a claim needs to be filed later.”

Is there any advantage to registering my product?

Fairly soon after registering a product, I got the following email (likely to be sent via postal mail as well):

So that we may expedite potential repairs for your product, please return this form with the

following required documentation, in the enclosed pre-addressed envelope:

- A copy of your itemized sales receipt;

- A copy of your credit card slip reflecting the purchase of your item;

- A copy of your manufacturer’s written U.S. warranty information. (required only for products

with a purchase price over $100.00).Please note that all documents must be legible and any omission of required documents or

information may result in the delay of any future claims.Should your product ever need service or if you have any questions regarding the VISA Warranty

Manager Service, please call our customer service department at 1-800-231-3250, or you can visit

us on the web at www.visa.com/eclaim. Representatives are available to assist you 24 hours a

day, 365 days a year.Please note: this item may be eligible for an extended service agreement known as a Visa

Performance Guarantee (underwritten by Westchester Fire Insurance Company). Call 1-800-231-

3250 for details!We appreciate the opportunity to serve you.

Sincerely,

Customer Service

Warranty Manager Program

That’s pretty cool. I’m all about having someone else file my receipts. Sure, I have to send it to them, but that’s easier to do than finding them when the TV/camera/etc. breaks.

A conversation with Lowell Bryan and Richard Rumelt – McKinsey Quarterly – Strategy – Strategic Thinking

Enjoyed the McKinsley Quarterly podcast A conversation with Lowell Bryan and Richard Rumelt – McKinsey Quarterly – Strategy – Strategic Thinking (link is to transcript of the interview).

They make the point that we were all looking at the wrong metrics before the mortgage/credit crisis occurred. Things such as GDP, etc. have no correlation with people making much larger mistakes (packaging high-risk loans as low-risk).

Here’s a really good analogy:

At the heart of this failure is what I call the “smooth sailing” fallacy. Back in the 1930s, the Graf Zeppelin and the Hindenburg were the largest aircraft that had ever flown. The Hindenburg was as big as the Titanic. Together these vehicles had made 620-odd successful flights when one evening the Hindenburg suddenly burst into flames and fell to the ground in New Jersey. That was May 1937.

Years ago, I had the chance to chat with a guy who had actually flown over Europe in the Hindenburg. And he had this wistful memory that it was a wonderful ride. He said, “It seemed so safe. It was smooth, not like the bumpy rides you get in airplanes today.” Well, the ride in the Hindenburg was smooth, until it exploded. And the risk the passengers took wasn’t related to the bumps in the ride or to its smoothness. If you had a modern econometrician on board, no matter how hard he studied those bumps and wiggles in the ride, he wouldn’t have been able to predict the disaster. The fallacy is the idea that you can predict disaster risk by looking at the bumps and wiggles in current results.

The history of bumps and wiggles—and of GDP and prices—didn’t predict economic disaster. When people talk about Six Sigma events or tail risk or Black Swan, they’re showing that they don’t really get it. What happened to the Hindenburg that night was not a surprisingly large bump. It was a design flaw.

This theory of large disasters makes a lot of sense to me: it almost seems like a necessary condition for a large disaster that the conventional metrics wouldn’t predict it. We’re not all stupid; if some metric predicted disaster, someone would take advantage of it–and in free markets, each opportunistic person forms a feedback loop that corrects the original market inefficiency (in this case, averts disaster by gradually devaluing mortgage-backed securities).

The interviewees go on to say that the systematic design flaw was treating correlated securities as having independent risk. That seems like a contradiction to me: aren’t things such as correlations and risk well-established metrics? So, weren’t the metrics available at the time able to predict this disaster?

According to the interviewees, these metrics weren’t being analyzed within the scope of economic stability. Instead, GDP (and GDP volatility) was being tracked. I don’t know enough to know whether they are right or wrong. But, it makes for thought-provoking reading.

Labor Market Making

Executive Summary

in the same way that a commodities market maker ensures liquidity in a market and reduces the chaos that might be caused by low participation in a market, is there a way to formulate a labor market maker? Can this same concept be applied to the labor market?

Arcade Fire: Wake Up

[mp3 keywords=”Arcade Fire Wake Up” title=”Wake Up”]

… as featured in the trailers for Where the Wild Things Are.

Got slammed (or crammed) by ESBI & “EMAIL DISCOUNTS, LLC”

Update 11:19 PM

Called ESBI who connected me to “Email Discounts LLC”. They said that “my wife”

signed up for their service using Yahoo email account. I informed them that she does not have a account. They said they canceled the

account. I voluntarily gave them my gmail account for confirmation of cancellation–I figure Google is pretty good about spam–but maybe that’s what their really after.

They said that all charges (including taxes) would be reimbursed and no further

charges would occur because the account was canceled. We’ll see.

Original Post

My monthly bill from AT&T was unusually high this month. My father-in-law (who works for AT&T) warned me about this.

In the bill, I find a section under the heading “Enhanced Services Billing, Inc.” with a logo:

ESBI Logo

(account information)

| Billing Date | Mar 22, 2009 |

| Questions? | 1-888-288-3724 |

Below this, the following is written:

Important Information

This portion of your AT&T bill is provided as a service

to the above company. Please review all charges

carefully – they may include those of a service

provider not shown on a previous bill. Unpaid accounts

may be subject to collection action. Other services may also be

restricted if not paid. If you have questions about any

of the charges appearing on this page, please call the

number shown above.

The bills themselves are:

| EMAIL DISCOUNTS, LLC # | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For billing questions call 1-800-410-5781 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | -01 | 03-20 | EMAIL DISCOUNTS, LLC MONTHLY FEE | 14.95 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Rest assured they were not authorized.

Further research on the web indicates that ESBI is associated with fraudulent charges on numerous telephone bills (see the comments). Guess I’ll have to call them tomorrow to get my money back.

It amazes me that in a time when households are watching every dime, no one is doing anything about this fraud.

The beauty of dollar-cost averaging | a bear market strategy

MAJOR DISCLAIMER: I am not a financial analyst/expert, and I know nothing about stocks, markets, and money. If I did, I would have probably figured out how to monetize this blog. If you want real financial advice, seek a financial adviser.

Dollar-cost averaging is a phenomenon that occurs when you regularly invest the same amount of money in a stock no matter what happens. What tends to happen when you adopt this head-in-the-sand attitude is that when stocks are high, you end up buying fewer shares; when stocks are low, you end up buying more shares.

Note that the old adage of “buy low, sell high” is still the best you can do. However, (as Burton Malkiel points out), timing the market on these highs and lows is extremely difficult.

Here’s an example. Let’s say for 12 months, I invest in a stock. The first 6 months, the stock goes up, then returns to its initial price. The next six months, the stock goes down then returns to its initial price. Let’s say I invest $1 per month in the stock no matter what the price is doing. Here’s a table with the numbers:

| month | price | shares purchased | cumulative shares purchased | average price | total value | gain/loss |

| 1 | 1 | 1 | 1 | 1 | 1 | 0 |

| 2 | 1.1 | 0.91 | 1.91 | 1.05 | 2.1 | 0.1 |

| 3 | 1.2 | 0.83 | 2.74 | 1.09 | 3.29 | 0.29 |

| 4 | 1.3 | 0.77 | 3.51 | 1.14 | 4.57 | 0.57 |

| 5 | 1.2 | 0.83 | 4.34 | 1.15 | 5.21 | 0.21 |

| 6 | 1.1 | 0.91 | 5.25 | 1.14 | 5.78 | -0.22 |

| 7 | 1 | 1 | 6.25 | 1.12 | 6.25 | -0.75 |

| 8 | 0.9 | 1.11 | 7.37 | 1.09 | 6.63 | -1.37 |

| 9 | 0.8 | 1.25 | 8.62 | 1.04 | 6.89 | -2.11 |

| 10 | 0.7 | 1.43 | 10.04 | 1 | 7.03 | -2.97 |

| 11 | 0.8 | 1.25 | 11.29 | 0.97 | 9.04 | -1.96 |

| 12 | 0.9 | 1.11 | 12.4 | 0.97 | 11.16 | -0.84 |

| 13 | 1 | 1 | 13.4 | 0.97 | 13.4 | 0.4 |

The thing to take away from this is that at the end of the 13th month, I have made some money. It may not seem like a lot of money, but the stock price did not go up; it’s exactly where it was when I started. In general (though not always), the stock market goes up over long periods of time (5-10 years), so I’ll be even better off than in this pessimistic (though timely) example.

Sure: I could’ve made more money if I sold all that I had during the 4th month (when the stock price was high), and then just waited until the 10th month (when the stock was low) to buy everything back. However: that would require a great deal of prognostication.

With dollar-cost averaging, I can make money withour requiring the stock to go up. Of course, if it goes down, I don’t make money–unless I keep investing and it eventually goes up.